The Bank of Canada has started its rate-cut cycle, which can run up to 2%—2.5% overall when it is done. This easing cycle reverses the painful situation for homeowners, Bankers, Business Owners, Home Builders, and the entire real estate industry.

How transformative will it be? Here's a preview of what to expect.

#1: More Borrowing Capacity

With the start of the rate cut cycle, lower rates are expected to decrease the qualification/stress-test rate. This, in turn, will provide borrowers with more purchasing power, thereby enhancing homebuyer sentiment and potentially leading to increased real estate market activity.

Given the current pent-up demand from homebuyers and investors, decreased interest rates will lead to increased activity in the real estate market. This will result in new purchases and more refinancing driven by lower rates.

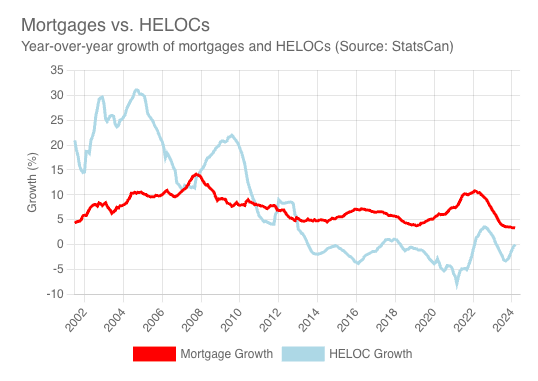

It's important to note that the slight increase in borrowing capacity is not expected to immediately trigger a surge in mortgage transactions initially. Instead, it is likely to be a gradual process, mirroring the decrease in interest rates. If economic inflation remains lower and we consider historical trends, mortgage growth could rise from 3.33% to around 6.25% over approximately 18 months.

#2: Variable Rates vs Adjustable Rates

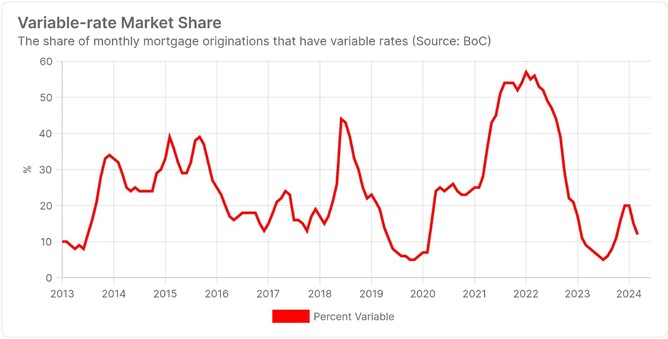

A few months of lower inflation reports could pave the way for more BoC rate cuts, making variable-rate borrowing a better choice in the next few years.

This is where we need to understand the advantages of adjustable-rate mortgages from lenders like Scotia Bank, National Bank and many non-bank lenders. They change the monthly payments based on the prime rate, resulting in monthly payments. When the rate went up, they were given a proverbial “time-out” by the borrowers. Now that the rates are in reverse, it could mean with every rate cut, borrowers will be getting a reduction in their monthly payment. The reduction will be about CAD $15 for every 100K mortgage. For example, if you owe 700K on the mortgage, your payment reduction will be CAD $105 for the next month.

On the other hand, variable-rate or fixed-payment mortgages will be sent to the “dog house” from the “pedestal” they were in the last few years. When the rate goes up, these mortgages hold their payments static while reducing the principal payment and increasing the interest payment. Some of these mortgages are now interest-only or negative amortizing. This means they will trigger massive payment increases, requiring the borrowers to refinance their mortgages and manage the payment shock.

#3: Better short-term rates

As of this writing, the Canada 5-Year Government Bond has been trending lower than 30 days. It's only a matter of time before we see uninsured nationally available rates in the low 5’s or high 4’s again.

This also means a reduction in posted short-term rates. Since the banks use the posted rates, compared to your current contract rate, when calculating the IRD penalty for a fixed-rate mortgage, you will trigger those unpleasant and hefty penalties.

#4: Lower renewal worries

We have discussed the “renewal wall” that Canadian homeowners will face in the next few years. If the BoC’s outlook is correct—a 1.75% drop in the next few years—it will still be a wall, but it may be padded with some soft material to reduce the blow.

We must remember that the actual rates and amortization options available to borrowers from their broker at renewal will likely be more favourable than the conservative assumptions in this BoC chart above.

As mentioned above, there will be a financial strain in the next few years, but it probably won't be accompanied by widespread defaults, as some would expect.

Here are reasons why we think there won't be a massive default risk.

federally-mandated mortgage relief, like re-amortization at renewal

4-5% annual income growth

With lower rates and increased borrowing capacity, a liquid housing market to sell into in most regions.

There will likely be more pain in the unregulated mortgage space like private lending. These lenders might not be as accommodating as the federally regulated lenders.

Even with federally regulated lenders, Canadians will face challenges when looking to change lenders on renewal on uninsured mortgages due to re-qualification requirements like the stress test, unlike for insured mortgages.

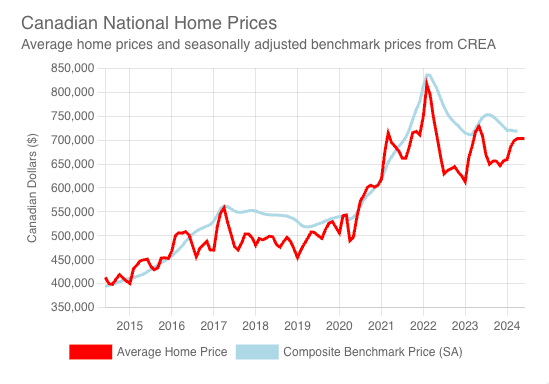

#5: Home prices will go up again

Despite the prime rate reaching a 23-year high and record unaffordability, home values have remained steady for two years except for a few pockets. Suppose interest rates continue to decrease, and there are no major negative impacts on employment or immigration and lower housing starts. In that case, it's difficult to imagine that home prices won't increase again soon.

Certain regions, like Calgary and parts of the Atlantic, could experience even faster growth due to population increases and lower average house prices. Even the condo markets in Toronto and Vancouver, which are currently experiencing tough times, might see some improvement if this trend continues.

#6: Early renewal offers and Switches.

Given the exceptionally high number of renewals and refinances expected, banks will likely intensify their efforts to retain customers further. They are already making significant attempts to keep clients, offering “special early renewal rate” offers, especially given the low transaction environment.

As mentioned in one of my previous articles, “The Canadian Mortgage Charter” mandates that lenders " contact homeowners four to six months in advance of their mortgage renewal to inform them of their renewal options." This will encourage the lenders to contact borrowers more frequently and early to lock them in for longer-term mortgages.

Whatever your situation, it’s always better to talk to your mortgage professional and review your options. You need someone who will understand your needs and find the best product to fit your situation rather than someone who will try to lock you into a long-term commitment.

Another important point is that switching lenders is often easier and less costly than borrowers think, especially if you got the CMCH insurance when you got your mortgage. Some people are unaware that CMHC (or any default insured) insured borrowers can move to a different lender without going through the stress test. This is true even if the value of their property has increased to over $1 million since they obtained their original mortgage (thanks to the grandfathering rule). Customers can often capitalize on up to $3,000 in penalties, fees, and accrued interest (from their last payment). This is in addition to any lender rebates that may be available.

Unfortunately, this is available only for default-insured borrowers. We hope the regulators will allow uninsured borrowers to follow suit, helping to bring down the “renewal wall” that the borrowers face.

#7: Lenders will be slow

With rates sliding and more mortgage activity, many lenders will slow response time. We’ve already seen some lenders flat-out refuse mortgage applications as they’ve run out of funds. So make sure you keep sufficient time to complete your mortgage transaction.

#8: Investor activity will increase

In many parts of Canada, generating positive rental cash flow from a single-family property is difficult. With interest rates decreasing and house prices stable, we anticipate investors will use short-term fixed-rate or adjustable-rate mortgages to enter the market.

We've already observed well-capitalized investors taking the first Bank of Canada interest rate cut as a signal to re-enter the real estate market.

#9: Deposit rates will go down.

You may want to keep that 5.4% 18-month GIC in your TFSA until it matures, as it may be the last time we see rates like these, similar to your 1.49% fixed-rate mortgage.

When the borrowing rate decreases, so will the deposit instruments fund the lending instruments. This is unfortunate for the savers on their GICs but will help them with the overall value of their portfolio if they own a house.

Conclusion

When interest rates decrease, they will impact various aspects of our lives. It's important to always consult with your mortgage broker to explore the best options before making any significant decisions.