Mortgage payments are an essential part of your financial responsibilities after purchasing a property. However, understanding when and how these payments are due can be confusing, even for seasoned homeowners. To avoid financial pitfalls, it's crucial to grasp the intricacies of mortgage payments and their timing.

Let's explore why mortgage payments are typically made in arrears and not in advance, using real-life case studies to understand further.

Mortgage Payments: The Basics

Mortgage payments in Canada are generally made in arrears. This means that the payment you make on the 1st of the month covers the interest accrued during the previous month. This is different from many other payment types where you pay in advance for the upcoming month.

Case Study 1: Sami's Confusion About Private Mortgages

Sami accepted a one-year private, first mortgage on April 14, 2023, and provided 12 post-dated cheques from June 1, 2023, to May 1, 2024. He was surprised when his lender contacted him in March 2024 about renewing or paying off the mortgage. Sami believed the maturity date should be June 1, 2024, thinking his final payment on May 1st covered an additional month until June 2024.

Sami’s Mortgage Terms:

Balance Due Date: May 1, 2024

Interest Adjustment Date: May 1, 2023

Payment Timing: Payments are calculated monthly, not in advance

Outcome: Understanding the Terms

Sami initially blamed the lender for allegedly withholding one month's payment. After involving a real estate lawyer to clarify the situation, it became evident that the May 1, 2024 payment covered April, not May. This misunderstanding led to significant fees and expenses as the current lender withdrew the renewal offer, forcing Samito to find a new lender due to his initial hostile reaction the lender.

Understanding Payment in Arrears vs. Payment in Advance

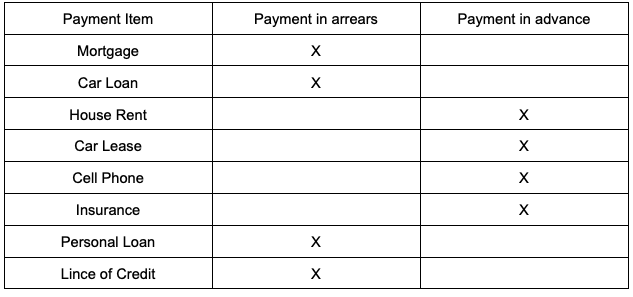

Mortgage payments are made in arrears, meaning the payment you make on the 1st of each month covers the interest for the previous month. This differs from other payments, such as rent, cell phones, or car leases, which are paid in advance.

Why Are Mortgage Payments Made in Arrears?

Interest accrues on your mortgage balance daily, starting when the mortgage is advanced. At the end of the month, you owe the accrued interest for that month. Hence, your monthly mortgage payment covers this accumulated interest on the 1st of the following month.

Here’s a table to illustrate the difference:

Case Study 2: Nishi and Raj's Mortgage Renewal

Nishi and Raj's 5-year mortgage was scheduled to renew on May 1, 2024. They secured a new mortgage with a different bank and set the closing date for April 30, 2024. However, due to their travel plans, the closing was delayed to May 3, 2024, leading their old bank to collect a full payment on May 1, 2024.

Outcome: Keeping Cool

Nishi and Raj initially panicked, thinking the payment collected on May 1 was for May. After consulting with us, they understood that the payment on May 1 covered the interest for April. This understanding helped them avoid further confusion and stress.

What is an Interest Adjustment?

An interest adjustment is a one-time adjustment made by lenders to align the payment collection date with the mortgage advance date. For example, if your mortgage is advanced on the 15th but the payment date is the 1st, the lender may collect interest for the days from the 15th to the 1st as an adjustment.

Key Takeaways for Homeowners

Carefully review your mortgage documents and discuss payment schedules with your mortgage professional.

Understand that mortgage payments are for the previous month’s interest, not an advance payment.

Seek advice from your mortgage professional or real estate lawyer if you are unclear about your mortgage terms.

Clear communication and understanding of these terms can prevent misunderstandings and maintain a positive relationship with your lender.

By understanding these details, homeowners can navigate their mortgage agreements more effectively and avoid financial misunderstandings.