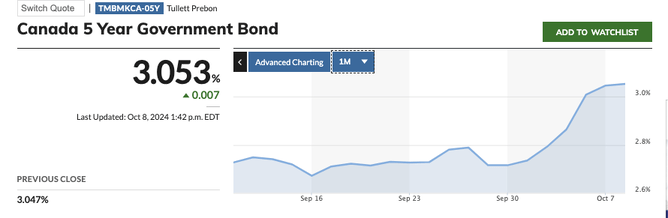

For those of you keeping a close eye on bond yields, you might have noticed an unexpected shift over the past few weeks. While many anticipated rates to head lower, the 5-year Government of Canada yield has moved in the opposite direction—up 33 basis points in just two weeks! So much for the certainty that rates were only going to fall.

Sorry to burst the bubble, but rates can move in both directions—especially when you least expect it.

Is This the Work of the Bond Vigilantes?

Could we be seeing the bond vigilantes, those market forces that demand proper returns for the risks they take, finally stepping in? Maybe. Is this Mr. Market’s way of saying, “We need a better return for the risk we’re carrying”? It certainly seems that way.

But the big question is, why the sudden change?

A Fire Lit Under the U.S. Economy

Two weeks ago, the U.S. economy seemed to be slowing down, with markets predicting aggressive interest rate cuts. The Fed, under Jerome Powell, seemed poised for a 50-bps rate cut. But now, the U.S. employment numbers have turned the narrative on its head. The job market is booming—strong doesn’t even begin to describe it.

Job creation is firing on all cylinders, and while many expected a rate cut, the latest data suggests the exact opposite might be necessary. With this kind of job growth, a 25-bps rate hike could even be on the table.

Now, to be clear, I’m not predicting that the Fed will raise rates just yet. However, if next month’s job report is anything like this one, then further rate cuts from the Fed will be off the table for the rest of the year.

Impact on Bond Yields and the Canadian Dollar

This morning, bond yields shot up like a rocket, largely in response to the U.S. employment data. The Canadian dollar also took a hit as expectations of further rate cuts dwindled. With the reduced likelihood of aggressive action by the Fed, we could be seeing the markets adjusting their expectations accordingly.

What Does This Mean for the BoC?

For those of you looking ahead to the next Bank of Canada meeting, the odds of a 50-bps cut have slimmed considerably today. While it's still possible, a more likely scenario would be a 25-bps cut. Of course, there’s still a lot that could change before the Bank’s October 23 meeting—especially with this week’s Canadian employment report still on the horizon.

Key Takeaways:

The 5-year Government of Canada bond yield has increased 33 basis points in two weeks.

Strong U.S. employment numbers have led to reduced expectations of a Fed rate cut.

The odds of a 50-bps cut from the Bank of Canada have diminished, with a 25-bps cut looking more likely.

Stay tuned, because if there’s one thing this market is showing us, it’s that things can change quickly—and often in the opposite direction of what everyone expected.