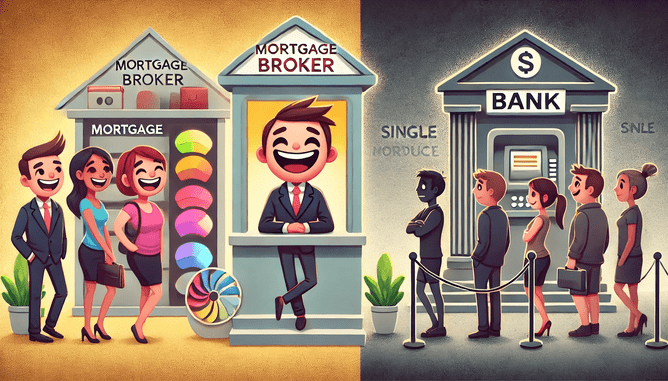

With Canada’s mortgage market bracing for one of the largest renewal waves in recent memory, there’s never been a better time to call in a mortgage broker. And by “call in,” I mean get someone in your corner who will make this decision more than a game of eeny-meeny-miny-mo with your mortgage. Let’s talk about why a mortgage broker could save you more than just a few bucks—they could save you the hassle of being squeezed by a single bank’s one-size-fits-all approach.

Here are six reasons why talking to a broker before your bank could pay off in next few years.

1. Options Galore: A Buffet of Lenders vs. A Bank's Set Menu

Imagine walking into a restaurant where the chef only serves one dish. Sure, that might work if you’re just in for a burger and fries, but it’s hardly a dinner party if your tastes run beyond the basics. Banks often serve up their own rates and terms without much wiggle room, whereas a mortgage broker brings you a smorgasbord of options.

Big banks? Check.

Mortgage finance companies? Absolutely.

Credit unions, alternative lenders, and even private lenders? Yep, those too.

Brokers aren’t tied to just one lender—they’re like Canada’s Vegas buffet of mortgage products, and they serve it up with a side of savings you won’t see on your bank’s renewal letter.

2. Uncover Hidden Deals and Save Big

Did you know that lenders hide their best rates like the last beer at a summer cottage party? Banks have been known to reserve their most attractive rates for those who threaten to walk away. A mortgage broker can help you skip that whole drama by scouting out the best rates from multiple lenders, even leveraging their own relationships to score you discounts you might not otherwise see.

Picture it: the average Canadian mortgage is around $500,000. A broker who can shave even 0.25% off your interest rate could save you over $5,000 in interest over five years. Now imagine what you could do with that extra cash—not too shabby, right?

3. Strategy: Because Mortgages Aren't Just About the Rate

Mortgages are like the financial equivalent of buying a new car; it’s not just about the sticker price but also about maintenance, customization, and longevity. A broker can help you devise short- and long-term strategies based on your financial goals. Want to keep your payments low now with flexibility to switch later? Trying to pay off high-interest debt and make your mortgage work double duty?

Brokers have the tools to run real simulations—no crystal balls, just solid amortization math—that can show you the big picture over the term of your loan. Unlike banks, who tend to push their five-year fixed rate like it’s the only item on the menu, brokers will work with you to tailor a plan that grows with your finances.

4. One-on-One Personalized Service (No Call Centre Limbo)

If you’ve ever had the pleasure of dialing a 1-800 number only to be greeted by an automated phone system? You know that personalized service isn’t exactly the hallmark of big banks. Mortgage brokers, on the other hand, are a phone call or text away. Want to discuss your mortgage options? You’ll be talking to a real person—not a machine.

Brokers work with you, not around you. They’re not going to transfer you to a department that "doesn’t handle that kind of inquiry" or put you on hold because they’re short-staffed. When you call your broker, you get answers, advice, and—best of all—a human who actually knows your name.

5. Cutting-Edge Advice for Complex Scenarios

Today’s mortgage market is a jungle of options, and not every borrower fits the cookie-cutter mold of traditional banks. Brokers can offer you:

Debt consolidation advice to decide if it’s time to pay off high-interest loans with your mortgage.

Flexible refinance options that could allow you to access funds mid-term without penalties that sting.

Investment strategies, including guidance on leveraging rental properties and using home equity lines of credit (HELOCs) strategically.

When rates are fluctuating like they’re on a trampoline, a broker can help you stay steady and avoid financial faceplants. They’re like that savvy friend who knows all the best restaurants in town and gives you the heads-up on where to go—and, more importantly, where not to go.

6. Making the Most of Mortgage Perks (That Banks Keep Quiet)

In the bank’s world, perks are sometimes hidden, but a broker will bring them into the light. Brokers often have the flexibility to offer cashback incentives and negotiate for special perks. These can be lifesavers, especially if you’re planning to stick with the mortgage for the long haul. Imagine getting the same interest rate as the bank but also pocketing a $2,000 cashback bonus.

They can also provide flexibility, such as skipping payments when life throws you a curveball or switching terms when interest rates change mid-mortgage. When it comes to the long game, brokers are experts in making sure you’re positioned to save at every turn.

Why Choose a Broker? Let’s Sum it Up

More Options: Banks offer limited choices; brokers offer a range of lenders and deals.

Money-Saving Power: Brokers can uncover hidden discounts, cashback options, and other perks.

Personalized Service: Say goodbye to call centre queues and hello to direct, human interaction.

Strategic Insight: Brokers don’t just find you a mortgage; they help you map out a financial plan.

Extra Flexibility: Need a financial pivot? Brokers offer customization banks often can’t match.

In a year where mortgage competition is going to hit Canadian shores with the intensity of a hockey final, a broker isn’t just a middleman—they’re your financial playmaker. So before you dial your bank’s call center, take a minute to connect with a mortgage broker. In the next few years, it could be the best financial call you make.